michigan gas tax increase history

The same three taxes are included in the retail price on. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well.

Volvo From Tech Superiority To Sub Brand Minority To Safety Priority To Design Authority

The Michigan Legislature upped the states gasoline tax in 2017 from 19 cpg to 263 cpg after then-Gov.

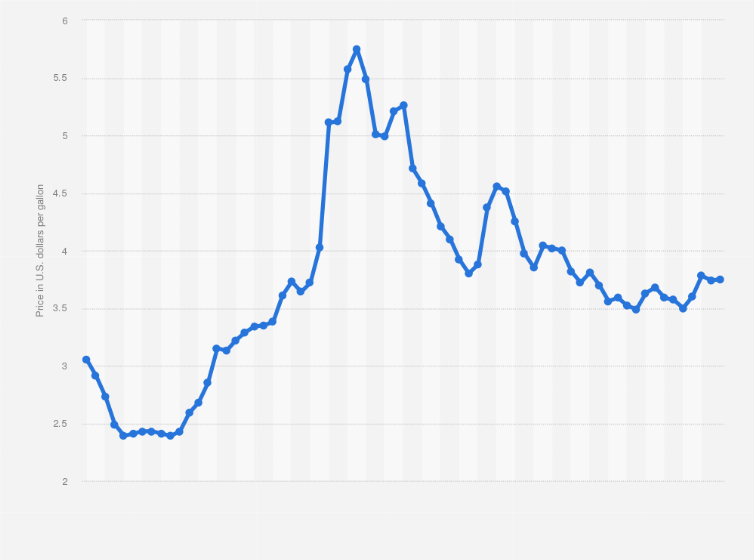

. This chart shows the relative size of historic gasoline tax increases in Michigan Author. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. Heres what MDOT says on the issue.

Increased Gas Tax rate to 45 cents per gallon. In the past week Michigan gas prices have risen to an average of 425 a gallon for regular gas. Rick Snyder a Republican signed the increase into law in Nov.

For fuel purchased January 1 2017 and through December 31 2021. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. 1 2017 as a result of the 2015 legislation.

Thirteen states have gone two decades or more without a gas tax increase. Diesel Fuel 272 per. Under pressure to mend roads and bridges Michigan senators are considering whether to significantly increase gasoline taxes within five years and then allow annual increases to.

In Michigan three taxes are included in the retail price of gasoline. They would pay at least 12 cents a. The tax on regular fuel increased 73 cents per gallon and the tax on.

Didnt gas taxes just go up. Gasoline 272 per gallon. For fuel purchased January 1 2022 and after.

Nineteen states have waited a decade or more since last increasing their gas tax rates. Gas taxes Created Date. Gasoline 263 per gallon.

1 2020 and Sept. The current state gas tax is 263 cents per gallon. The substitute passed by voice vote in the Senate on May 21 2014.

In 1960 voters approved an increase of the 3 sales tax to 4. Gas and Diesel Tax rates are rate local sales tax varies by county and city charged in PPG Other Taxes include a 075 cpg UST gasoline and diesel Hawaii. And the states gas tax as a share of the total.

0183 per gallon. Michigan gas tax increase history Monday April 25 2022 Edit. Voters were asked to repeal the 2017 law last year at the ballot box but they decided to keep the reform intact by a margin of 57 to 43 percent.

Diesel Fuel 263 per gallon. Mar 25 2020. This would represent a tax hike of 12 billion at current fuel prices.

As of January of this year the average price of a gallon of gasoline in Michigan was 237. Federal excise tax rates on various motor fuel products are as follows. The gas tax will rise by 56 cents per gallon under the last stage of an increase approved by lawmakers in 2017As in Illinois Californias gas tax rate will now also be adjusted each year to keep pace with inflation.

The 187 cents per gallon state gas tax and the 184 cents per. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline.

Alternative Fuel which includes LPG 263 per gallon. To adopt a version of the bill that would replace the current 19-cent per gallon gas tax and 15-cent diesel tax with a 95 percent wholesale fuel tax gradually increasing to 155 percent in 2018. So far in 2021 inflation has been unusually high.

Michigan enacted its first ever sales tax through Public Act 167 in 1933. Liquefied Natural Gas LNG 0243 per gallon. After 2017 the tax was indexed to the amount of inflation.

10172019 105048 AM. Repealed 1947 PA 319. Increased Motor Carriers Fuel Tax rate to 21 cents per gallon with 15 cent credit for fuel purchased in Michigan.

Increased Gasoline Tax rate to 19 cents per gallon. Added Chapter 2 Diesel Fuel Tax to 150 PA 1927 at 6 cents per gallon. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon.

An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon. Inflation Factor Value of Increase Percentage. Combined with Michigans 19-cents-per-gallon tax state drivers pay 374 cents a gallon in state and federal fuel taxes at the pump.

The 3 sales tax was on retail sales of tangible goods. That makes the total gas tax nearly 075 a gallon the highest rate in state history. Gasoline 272 per gallon.

A regulated natural gas utility serving southern and western Michigan. 1 Among the findings of this analysis. Michigan fuel taxes last increased on Jan.

The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased.

Federal Inaction On The Gas Tax Is Costing Us Dearly Itep

Motor Fuel Taxes Urban Institute

Why Globalization Works Yale Nota Bene Martin Wolf Global Book Summaries Books

My First Car Was Not A Car First Car Car Buying Car

Michigan Tax Rates Rankings Michigan Income Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Highest Gas Tax In The U S By State 2022 Statista

Why Are Gas Prices So High Forbes Advisor

How High Are Cell Phone Taxes In Your State Tax Foundation

South Carolina Gas Tax Increases On July 1 Wcbd News 2

The Relative Value Of 100 Which Metro Areas Offer The Biggest Bang For Your Buck Vivid Maps

Highest Gas Tax In The U S By State 2022 Statista

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

1924 Ad Antique Enclosed Hudson Coach Automobile Super Six Chassis Car

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence